About Programs

SBALENDING.COM is an easy to use portal to provide applications and basic information about the loans we offer. Use the product guide to see all loans.

SBA 7a Loans

We offer two types of SBA loans; the most popular is the SBA 7a loan transaction that has a maximum amount of $5,000,000. The SBA 7a loan is a simple transaction compared to the SBA 504 due to there is one closing, one lender, and one loan. For more information on the loan program you may review the content page SBA 7(a) or visit sba.gov.

Eligibility:

- – Project costs are flexible and can be used for any legitimate business purpose. This includes a variety of things such as land acquisitions and improvements, construction of a new building, tenant improvements, equipment purchase, soft costs, working capital, franchise fees, among other things.

- – Business must be for-profit and meet small business size standards or have a net worth of less than $7 million and net profit after taxes less than $2.5 million (two year average)

- – The business must occupy a minimum of 51% of an existing facility and 60% for new construction.

Advantages:

- – Easier process with one loan

- – Lower prepayment penalty vs. SBA 504 or USDA B&I

- – An array of uses

- – Fully amortizing loan, no call provisions or balloon payments

USDA B&I Loans

USDA B&I loans are similar to the SBA 7(a) program as it is one loan from Lender. In order to qualify, the majority of the collateral must be located in a “rural” area with a population of less than 50,000. To see if the address is eligible for a B&I loan click here. B&I loans range from $1,000,000 up to $25,000,000 and do not have the same “small business” size standards.

Eligibility:

- – Project costs are flexible as with the SBA 7(a) program. This includes a variety of things such as land acquisitions and improvements, construction of a new building, tenant improvements, equipment purchase, soft costs, working capital, franchise fees, among other things.

- – Must be in a “rural” area

- – Any legal entity, public or private organizations

Advantages:

- – No restrictions on size of company

- – One loan with the lender

- – There are no guarantee limits, thus multiple USDA loans are possible

- – Fully amortized loan with no balloon or call provisions

- – Typically a longer amortization period

To find out more information about the USDA B&I loans click here.

SBA 504 Loans

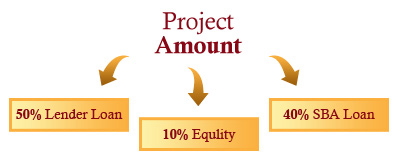

The SBA 504 loan program is a little different as there are two loans. The same objective is accomplished; however the lender provides a loan of no less than 50% of the total project. The SBA through a Certified Development Company (CDC) provides a loan of up to 40% of the total project and the balance is owner equity. The three parts:

- First Mortgage loan provided by Lender up to 50% of the project cost. This is a conventional type loan with a separate note, rate, terms, etc.

- Second Mortgage loan is provided by a Certified Development Company (CDC) and SBA and provides financing up to 40% of the total project cost or a maximum of $5,000,000. The term of the 504 loan can be 20 years for real estate and 10 years for equipment. The interest rate will be fixed for the maturity and is generally below market.

- The last piece is the borrower’s equity contribution. The borrower must inject 10% of the total project costs. If this is a start up business or the facility is special use, the down payment may be as much as 20% of the total project costs. Equity can be in the form of cash, equity in land/building supported by an appraisal, or other fixed assets that are part of the overall project.

Eligibility:

- – Project costs include a variety of things such as land acquisitions and improvements, construction of a new building, equipment purchase, soft costs, etc.

- – Business must be for-profit with net worth of less than $7 million and net profit after taxes less than $2.5 million (two year average)

- – The business must occupy a minimum of 51% of an existing facility and 60% for new construction.

- – Most businesses are eligible; however there are some businesses such as non-profit organizations, passive investor type transaction, or development type transactions that do not qualify.

Advantages:

- – Typically a lower down payment is required

- – Below market interest rate – fixed for the term (on the 504 piece)

- – Loan fees may be financed

- – Long-term financing, fully amortizing loan

Conventional Loans

Lender provides conventional loans to strong borrowers. Lines of credit can be established to help smooth cash flow for strong entities. Please contact us for more information on the conventional products.