All About the process

We try to make the process as easy for you as possible and have one application that will cover all the products offered. There is certain information that is needed in order to qualify the request in one product or another. All the paperwork is necessary to make a good credit decision and abide by the rules of each of the programs and is required by every lender.

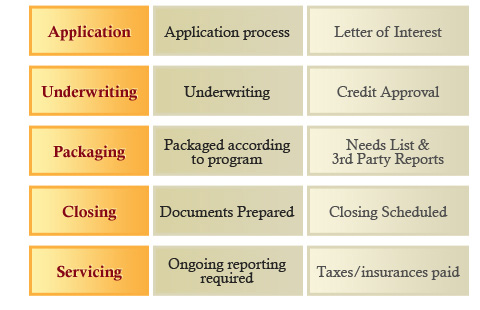

There is a five step process that we implement in order to take your loan application request to closing the loan and beyond. The process is set so the borrower will be aware of what is involved and helps manage expectations.

Step 1: Loan Application, pre qualification:

![]() The loan application starts with you contacting one of our loan officers and providing the necessary information requested (application). The loan officer will assist you in collecting all the information and will issue a letter of interest and likely visit the business or site to get a feel for your request. Once all the information is collected and the terms of the loan agreed, the loan will go to Underwriting.

The loan application starts with you contacting one of our loan officers and providing the necessary information requested (application). The loan officer will assist you in collecting all the information and will issue a letter of interest and likely visit the business or site to get a feel for your request. Once all the information is collected and the terms of the loan agreed, the loan will go to Underwriting.

Step 2: Underwriting / Credit Approval:

![]() The underwriting process takes all the information from the application process, and analyzes the request. The loan report and spreads are presented to the loan committee for approval. Once approved a commitment letter will be issued that outlines the terms of the approval.

The underwriting process takes all the information from the application process, and analyzes the request. The loan report and spreads are presented to the loan committee for approval. Once approved a commitment letter will be issued that outlines the terms of the approval.

Step 3: Packaging:

![]() After the loan has been approved and commitment letter signed, the loan will be packaged as an SBA 7(a) loan, SBA 504, or USDA B&I loan. You will be provided with a closing check list and we will begin preparing the file for closing. All third party reports are ordered if not already and title opened.

After the loan has been approved and commitment letter signed, the loan will be packaged as an SBA 7(a) loan, SBA 504, or USDA B&I loan. You will be provided with a closing check list and we will begin preparing the file for closing. All third party reports are ordered if not already and title opened.

Step 4: Closing:

![]() Once Lender has the approval from the SBA or USDA and is in receipt of the third party reports, the file will be ready to close. The documents will be prepared and a closing date will be assigned at your convenience.

Once Lender has the approval from the SBA or USDA and is in receipt of the third party reports, the file will be ready to close. The documents will be prepared and a closing date will be assigned at your convenience.

Step 5: Servicing:

![]() After the loan is closed the bank will contact your periodically about meeting the servicing requirements. These ongoing requirements are necessary and the responsibility of the borrower.

After the loan is closed the bank will contact your periodically about meeting the servicing requirements. These ongoing requirements are necessary and the responsibility of the borrower.

Items that will be needed in order to complete your request:

- Loan Application with management profile to be filled out by each 20% or more owner

- Business Financials:

- – Federal Tax Returns (last 3 years)

- – Interim business financials (income and balance sheet)

- – Business debt schedule (form enclosed in Application)

- – A/R and A/P aging reports dated same as interim balance sheet

- Personal Financials (20% or more owner)

- – Federal Tax Returns (last 3 years)

- – Personal Financial Statement (form enclosed in Application)

- – Personal Cash Flow Statement (form enclosed in Application)

- Miscellaneous as it pertains to each deal

- – Executed copy of the buy/sell agreement or real estate purchase agreement

- – Copy of Franchise agreement

- – Copy of lease or proposed lease

- – Copy of the contract/bid for work to be done (construction / renovations)

- – Legal Entity Documents:

- – Sole Proprietorship – DBA name / assumed name

- – Corporation – Articles of Incorporation and Bylaws

- – Partnerships – Partnership agreement

- – LLC – Articles of Organization and Operating Agreement